Britain’s trade in goods with the EU was very prominent in the news at the start of 2021. Lorries queued and exporters complained of new regulatory burdens and the actions of French customs following the end of the Brexit transition period on 31 December 2020. Trade in goods with the EU declined by 14% year on year in the first quarter of 2021.

However, this decline related only to the EU, only to goods and only to one quarter. The UK’s trade with the rest of the world (RoW) is growing, and this larger market is where exporters should now be focusing. In addition, the UK has a comparative advantage in services, and this has been boosted as businesses have adopted remote technology to deliver services as never before during the pandemic and lockdowns. At L.E.K., we’re helping our clients in transport, logistics, healthcare, financial services, industrials and consumer goods to negotiate the new landscape of international trade in services.

Let’s put this in a historical perspective. The UK has a stronger history of free trade than most countries, and Brexit can be seen as the latest chapter in this story. The repeal of the Corn Laws (removing tariffs on imported grains) in 1846 led to a rapid improvement in living standards as food became cheaper. Then in 1906, with political alignments somewhat reversed from today, the Liberal party won a landslide general election victory based on free trade, defeating the protectionist Conservatives.

Throughout the 19th and 20th centuries, Europe was richer than the rest of the world. However, the rest of the world has been catching up – and fast. Since 2000, the EU’s share of global GDP has fallen from 21% to 14% (it accounts for 6% of the global population).

Meanwhile, over the past 15 years, Britain’s trade with the RoW has been growing faster than its trade with the EU, falling below 50% after the global financial crisis. The EU’s share is inflated by the so-called Rotterdam effect, where cargo from RoW is trans-shipped via continental ports onto feeder ships to the UK and counted in EU trade figures. Brexit has accelerated this shift in UK trade away from the EU and towards non-EU markets, as can be seen with the beginnings of a shift to ports on the west of Britain gaining new vessel calls.

The friction observed earlier in the year was hopefully temporary. In the second quarter of 2021, trade in goods with the EU bounced up 18% to above Q1 2020 levels (pre-pandemic). Trade with RoW also recovered strongly and to a higher level than EU trade.

More significantly, this friction relates to goods. While the UK is the world’s ninth biggest manufacturer, according to the World Bank, it is relatively much stronger in export of services. Again, a historical perspective is useful here. David Ricardo, the 18th century political economist, argued in his theory of competitive advantage that you should not focus on what you’re best at in absolute terms. Instead, he said, look at where you’re better in relative terms - in other words your relative advantage over the competition. This is where gains from trade are highest for both parties.

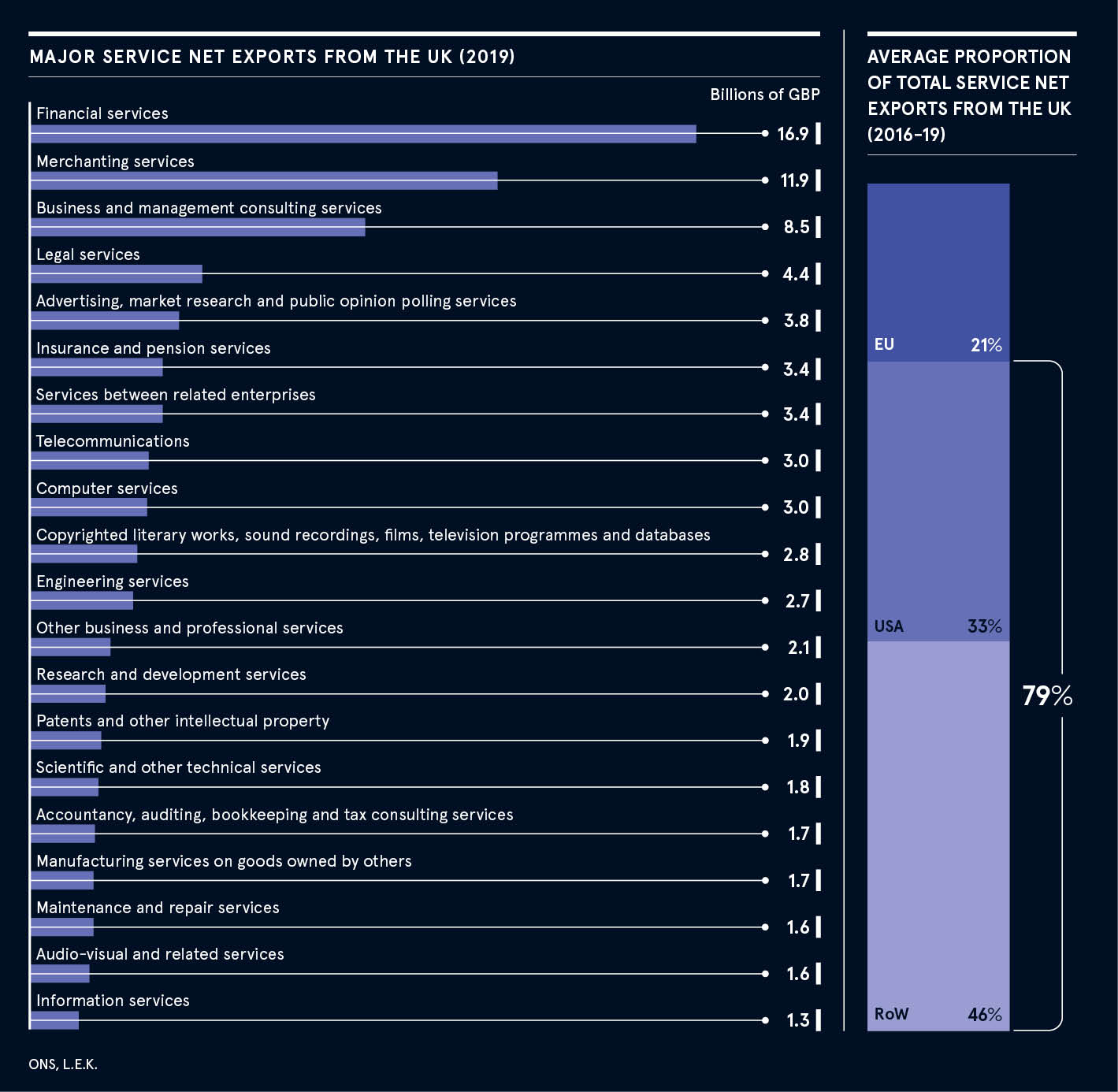

Today, the UK’s relative advantage is in high-value-added services. Thanks to an educated workforce, respected legal system, widely used language and density of high-value-added workers creating cluster effects, the UK is number two worldwide in service exports, according to the World Bank. The UK’s trade surplus in services is around £100bn a year, which is a very large annual benefit to the UK economy. This figure would be even larger - by up to £15bn a year - if the pre-Covid trade deficit in travel services (because Brits spent more abroad than visitors do in the UK) is reduced with less international travel in the future.

The surplus is driven in part by the strong performance of what the ONS calls ‘other business services’ such as education, recruitment and marketing. Much is intrinsically linked to high value-added goods, which increasingly contain a large service element in collaborative R&D, customisation, logistics, installation and servicing. Covid and lockdown have demonstrated how we can trade more services over long distances.

Our clients at L.E.K. who operate in these sectors have seen greater reach during the pandemic. They have served customers more effectively around the world remotely through rapid innovations in online models that facilitate everything from upfront qualification and sales, to negotiations, team selection, service delivery and project management.

The EU accounts for more than a quarter of the UK’s trade surplus in services, even though the EU has no single market in services and the Trade and Cooperation Agreement (TCA), signed between the EU and the UK, does not include much detail on services. The other three-quarters of Britain’s trade surplus in services derived from the RoW is growing faster. Service exports to RoW grew at 7% per year from 2000 to 2019.

Brexit may accelerate the trend in UK trade away from the EU and towards RoW. The pandemic and associated lockdowns have shown how more services can be delivered remotely using innovation and technology, launching greater opportunities to grow international trade in services, where the UK has strong comparative advantages. This may turn out to be an exciting phase for the UK’s export industries.

Global opportunities: what British exporters need to think about now

The continued faster growth of RoW markets and potential for ongoing friction in EU-UK trade are leading to a rethink of export growth priorities.

The Covid pandemic has emphasised and expanded how tradable services are. Business leaders are revising their business models towards remote, international delivery of services by exploiting new technologies and newfound trust in remote delivery.

This includes finding local partners and new international supply chains for the essentially face-to-face parts of service delivery.

Corporates are also engaging in M&A into the EU to smooth the local servicing of clients where that is needed.

As business and trade regulations evolve post-Brexit, hopefully towards more pro-competition policies, there is a window of opportunity for businesses to make the case to government for pro-competition changes.

Several government departments are exploring pro-competition reforms and they are yet to finalise their post-Brexit regulatory strategies.

For more information please visit info.lek.com/globaltrade

Promoted by L.E.K.